Stock Market Intelligence - Arjun Verma

Stock Market Intelligence - Arjun Verma

Ultimate book for Investors - Invest with Insights

Couldn't load pickup availability

Secure payment

Secure payment

Free shipping

Free shipping

Across 1400+ pin codes

Across 1400+ pin codes

Introducing the Ultimate Stock Market Book: Your Gateway to Informed investments

Unlock the full potential of your investments with our meticulously crafted Book, whether you’re starting with your first demat account or aiming to outsmart the market, Stock Market Intelligence is your go-to resource. Available exclusively through our online store, this book is designed to transform you from a novice investor into a confident, intelligent market player in India’s fast-evolving stock ecosystem. Grab your copy today and take control of your financial future!

What's Inside:

-

In-Depth Book: Gain a thorough understanding of the Indian stock market's intricacies, including key indices like NIFTY 50 and SENSEX, and stay updated with the latest market trends.

Why ?

Why ?

- Stay Informed: Keep abreast of the latest market movements and financial news to make timely investment decisions.

- Simplify Analysis: Streamline complex data, making analysis straightforward and accessible.

-

Enhance Decision-Making: Leverage comprehensive data and insights to optimize your investment strategies.

Take Control of Your Financial Future

Take Control of Your Financial Future

Don't miss this opportunity to elevate your investing experience. Secure Ultimate Indian Stock Market Intelligence today and embark on a journey toward informed and successful investing.

Note: This book is designed to provide educational resources and tools for investors interested in the Indian stock market. It is not intended as financial advice. Always conduct thorough research or consult with a financial advisor before making investment decisions.

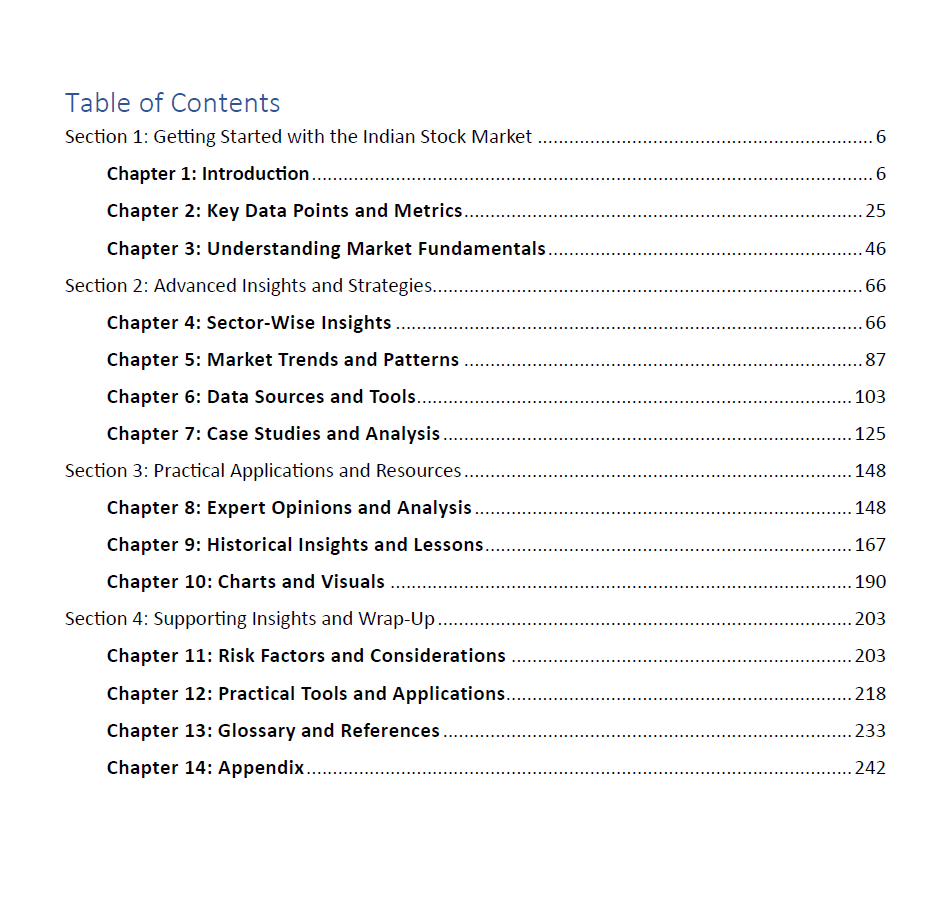

Beginner -Table of Contents

Beginner -Table of Contents

Section 1: Getting Started with the Indian Stock Market

Chapter 1: Introduction

Chapter 2: Key Data Points and Metrics

Chapter 3: Understanding Market Fundamentals

Section 2: Advanced Insights and Strategies

Chapter 4: Sector-Wise Insights

Chapter 5: Market Trends and Patterns

Chapter 6: Data Sources and Tools

Chapter 7: Case Studies and Analysis

Section 3: Practical Applications and Resources

Chapter 8: Expert Opinions and Analysis

Chapter 9: Historical Insights and Lessons

Chapter 10: Charts and Visuals

Section 4: Supporting Insights and Wrap-Up

Chapter 11: Risk Factors and Considerations

Chapter 12: Practical Tools and Applications

Chapter 13: Glossary and References

Chapter 14: Appendix

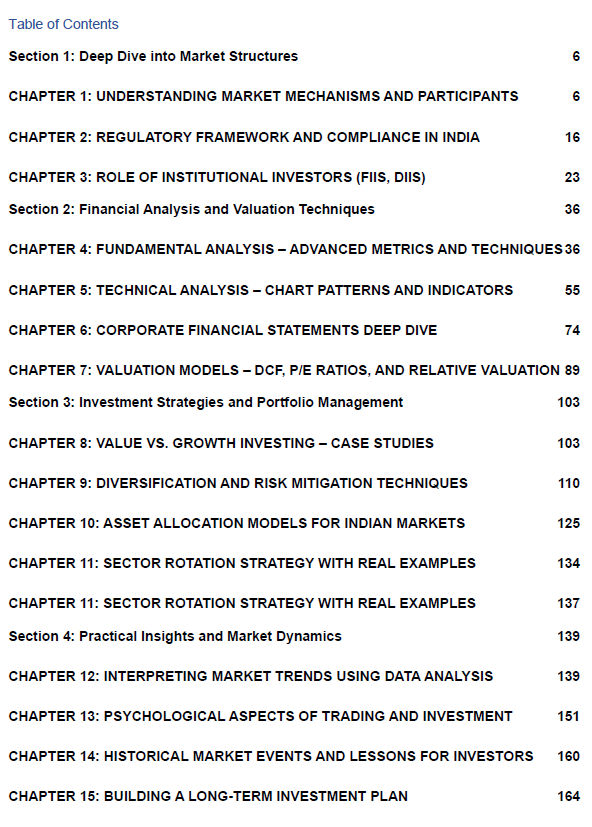

Intermediate -Table of Contents

Intermediate -Table of Contents

Section 1: Deep Dive into Market Structures

Chapter 1: Understanding Market Mechanisms and Participants

Chapter 2: Regulatory Framework and Compliance in India

Chapter 3: Role of Institutional Investors (FIIs, DIIs)

Section 2: Financial Analysis and Valuation Techniques

Chapter 4: Fundamental Analysis – Advanced Metrics and Techniques

Chapter 5: Technical Analysis – Chart Patterns and Indicators

Chapter 6: Corporate Financial Statements Deep Dive

Chapter 7: Valuation Models – DCF, P/E Ratios, and Relative Valuation

Section 3: Investment Strategies and Portfolio Management

Chapter 8: Value vs. Growth Investing – Case Studies

Chapter 9: Diversification and Risk Mitigation Techniques

Chapter 10: Asset Allocation Models for Indian Markets

Chapter 11: Sector Rotation Strategy with Real Examples

Chapter 11: Sector Rotation Strategy with Real Examples

Section 4: Practical Insights and Market Dynamics

Chapter 12: Interpreting Market Trends Using Data Analysis

Chapter 13: Psychological Aspects of Trading and Investment

Chapter 14: Historical Market Events and Lessons for Investors

Chapter 15: Building a Long-Term Investment Plan

Advanced -Table of Contents

Advanced -Table of Contents

Section 1: Advanced Financial Instruments and Derivatives

Chapter 1: Options Trading Strategies with Indian Case Studies

Chapter 2: Futures Contracts and Hedging Techniques

Chapter 3: Commodity and Currency Markets Overview

Chapter 4: Algorithmic Trading and Automation in India

Section 2: Strategic Investment Models

Chapter 5: Quantitative Analysis and Data-Driven Strategies

Chapter 6: Building and Backtesting Investment Models

Chapter 7: Advanced Risk Assessment and Management

Section 3: Global Markets and Impact on India

Chapter 8: Correlation Between Global Events and Indian Markets

Chapter 9: Analyzing Foreign Exchange Risks and Opportunities

Chapter 10: Cross-Border Investments: Opportunities and Challenges

Section 4: Regulatory Landscape and Market Ethics

Chapter 11: Navigating SEBI Regulations for Advanced Traders

Chapter 12: Ethical Trading Practices and Corporate Governance

Section 5: Real-World Case Studies and Expert Insights

Chapter 13: Analysis of Market Crashes and Recoveries in India

Chapter 14: Case Studies on Successful Long-Term Investments

Chapter 15: Interviews and Insights from Leading Market Experts

Section 6: Emerging Trends and Future of Stock Trading

Chapter 16: The Role of AI and Big Data in Trading

Chapter 17: ESG Investing and Its Impact in India

Chapter 18: Cryptocurrency and Blockchain's Influence on Financial Markets

Share